Invest with Sterling MF Today

9 Year | 1000+ Customers | 10Cr +Invested

Our

Partner

- What is GAURAV FINSERV ?

When it was started ? - How do I complete the registration

with GAURAV FINSERV? - I forgot my password.

How do I recover it? - How do I open a new account

and avail the Paperless investing services from gauravfinserv? - Fund of Funds

- What are dividend and growth options in a mutual fund?

- Should you choose the dividend option or the growth option?

- How different is GAURAV FINSERV from others?

- Explain in detail about the advantages of GAURAV FINSERV.

- How safe and secure is GAURAV FINSERV.com?

- Is GAURAV FINSERV authorized by SEBI and NSE?

- Who are the promoters of GAURAV FINSERV?

- Do you have any branches?

- How can we contact you?

- How secure is my data with GAURAV FINSERV?

- Can I invest through GAURAV FINSERV by going to a retail outlet?

- What is the AUM of your company?

What is GAURAV FINSERV ?

GAURAV FINSERV is value-added investment platform. Created and promoted by Mr. Gaurav kumar (ARN-69452)., the platform caters to retail Indian investors all over the world. By creating a Life Time FREE investment account, customers can get access to a wide array of investment products like mutual funds from all Asset Management Companies (AMC)s, and more. The platform is renowned for its unique expert investment advice, and more that help investors get more out of their investments.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

How do I complete the registration with GAURAV FINSERV?

If you are not aware how to continue with your registration and if you remember which email address you signed up with, then its very simple. Follow the below steps to complete the registration.

Access www.gauravfinserv.com

Login using the email address and the password.

If you do not remember the password click here to recover password.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

I forgot my password. How do I recover it?

Here is a link below, for you to recover your password.

https://www.gauravfinserv.com/content/jsp/registration/forgotPassword.

Do enter your registered email address with us in the username box and click on Submit.

Now access you email and click on the link in the mail to set up a new password.

Fill in the new password, confirm Now you may relogin to your gauravfinserv account.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

How do I open a new account and avail the Paperless investing services from gauravfinserv?

Opening a new account with gauravfinserv is quick, simple and free. You would just have to do the following:

- Register online on the Gaurav finserv website by providing your details. Take Print and Send Us At :

GAURAV FINSERV

4 STREET

JURAN CHAPRA

MUZAFFARPUR

842 001

BIHAR

- If you are not KYC registered and if you have an Aadhaar number, you get to enjoy the paperless investing services from us by verifying your Aadhaar and completing your KYC online within minutes.

- Post Aadhaar based eKYC verification, you could start investing with any of the listed fund houses on our website.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

Fund Of fUND

A mutual fund that invests in other equity, debt, gold or foreign mutual funds is a Fund of Fund(FOF). A FOF can invest in domestic mutual funds or in international funds. These funds could be investing in separate schemes in equity, debt or gold categories or in an asset allocated manner – that is a combination of equity, debt and sometimes gold. When they invest in a foreign fund, they become an international fund.

Popular fund of funds

Gold funds: Gold funds take the fund of fund route to investing in gold. They do so by investing in gold ETFs, typically from their own fund house. To invest directly in a gold ETF an investor would require a demat account. Gold funds facilitate investors to invest in gold without a demat. Furthermore in a gold Fund of fund, investors can do SIPs like they would with any other mutual fund. Some examples of gold Fund of funds are Axis Gold Fund, HDFC Gold fund, Kotak Gold fund and SBI Gold fund. They invest in their own gold ETFs.

Asset Allocation Funds: These funds seek to provide you with one fund that is diversified across different schemes from different asset classes. These can further be divided into two categories: dynamic funds that investing equity and debt mutual funds based on the market valuation, measured by metrics such as theprice to earnings ratio (P/E ratio) or price to book ratio or a combination such metrics. When the market metric such as the P/E ratio is high, the fund would reduce its exposure to its equity funds and instead increase in its debt fund holdings and vice versa. The fund and the fund manager will have stated internal metrics to decide the valuation band for such shifts. Franklin India Dynamic P/E Ratio FOF is a classic example of a fund which is dynamically managed based on valuations. Rest of the asset allocation fund of funds invest in a combination of equity and debt are often labelled as being aggressive, moderate or conservative ; accordingly fixing the allocation between equity and debt funds. Then there are multi asset fund of funds that take a strategic as well as tactical allocation to various asset classes such as equity, debt, gold and cash. While most fund of funds invest in their own schemes, there are multi-manager fund of funds that invest in schemes of other fund houses as well.

International fund of funds: Not all Indian mutual funds may have the resources and acumen to track international markets. Hence some of them choose to invest in an existing foreign fund, thus providing a route for Indian investors to invest in foreign equity funds. These funds allow you to invest in Indian rupees and you also redeem in your local currency. These funds can invest in a specific country such as US, China or Europe or across countries (global fund). They can also invest in a specific theme such as commodities, agriculture or energy and so on. While international funds provide exposure to foreign stocks for Indian investors, they carry dual risks. One is the market risk in that specific country or the theme risk. The other is the currency risk as your rupee will be subject to conversion volatility at the time of the fund deploying the money in such foreign markets.

Why fund of funds

Fund of funds suits investors to hold a basket of funds in one go – be it an asset allocated basket or one requiring to be dynamically managed in terms of asset allocation. This is convenient when with small sums, you can take exposure to multiple funds. Of course, there are advantages (discussed earlier)in gold funds and international funds as well.

However, on the flip side, fund of funds are treated as debt funds for tax purposes. That means despite taking equity exposure, they do not get the benefit of equity tax treatment. Also, most of these funds take exposure to their own fund house thus not providing you with different AMC styles or allowing you to choose the best in each AMC.

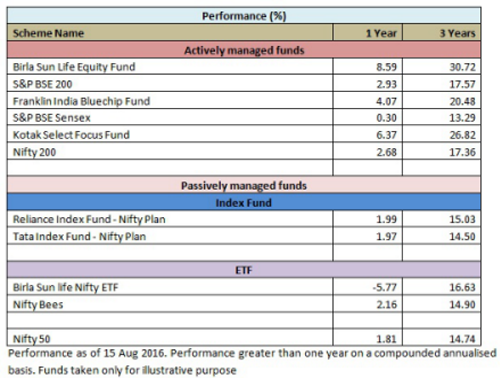

Active Vs. passive management of funds

Active management

In active management, the fund manager seeks to pick stocks with the aim of beating the benchmark and generating alpha. A fund manager cannot possibly invest in the same stocks as the/she has to take a call on picking stocks outside the index or keeping the exposure of sectors different from the index. Similarly, when the fund manager deems fit, he can raise cash or move some assets to money market instruments if he finds the markets are over-valued or too volatile.

Passive management

A fund is passively managed if the fund manager replicatesthe inde with exactly the same stocks and in thr same proportion. Here the fund manager is trying to replicate the index performance with as little tracking error (we will have a post on tracking error soon. Suffice to say that it refers to the deviation of the performance of the fund from its benchmark) as possible. Since the fund manager has to mimic the index he will have very little cash and that too, only to meet redemption proceeds. Index funds and ETFs are examples of passively managed funds. While ETFs are traded in the stock exchanges and can be bought through a demat and brokerage account, index funds can be bought like any other mutual fund. We will now look at how these categories of funds vary in their characteristics:

Expense ratio:

Passively managed funds sport a lower expense ratio as these funds need less management, given that they simply have to mimic the index. Identification of right stocks and sectors and opportunities are not needed with passive fund management. On the other hand, an actively managed fund will have a a team of analysts and fund managers who will study the various parameters of the economy and take calls on sectors and stocks in order to generate higher returns.

Turnover ratio: Turnover ratio in an actively managed fund will be high compared to a passively managed fund. This is so since a lot of active stock calls are taken continuously in active management while in a passively managed fund, the churn is only when there is a change ina stock in the index or when the fund has huge inflows and the same needs to be deployed in the index stocks.

Performance and volatility :

Though in actively managed funds the fund manager aims to create alpha there is also a possibility that the fund may underperform the if its calls go wrong. Active management also at times lead to higher volatility in returns compared with benchmark. Since a passively managed fund mirrors its benchmark in every aspect, the possibility that the fund may underperform its index by a huge margin is Low. At best the return differential could arise as a result of tracking error.

Active funds would generally score over passive funds in terms of the flexibility and diversification they offer. You can choose funds from different market cap segments or funds using different strategies (such as growth or value). You can also choose funds with a combination of equity and debt or those that invest based on market valuations. On the contrary, passively managed funds offer little choice in the Indian context. There are very few index funds/ETFs that are based on mid cap indices and none exists in the small cap space. Nor is there is a fund that will invest in a combination of asset classes. You cannot also have a passive fund reducing its equity allocation or upping it based on market valuations. Under unforeseen scenario such as 2008 or 2002 market crash, actively managed funds can sell the stocks in the fund and move the money to cash or money market funds to prevent further erosion of investment. While passively managed funds such as index funds and etfs will not be able to do so. In inefficient markets like India where there information dissemination is asymmetric and not all information regarding the stocks and markets are available to all, at all times, well managed active funds tend to outperform the markets, handsomely generating alpha. For those wanting to build wealth for the long term, actively managed funds do a better job than passive funds.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

What are dividend and growth options in a mutual fund?

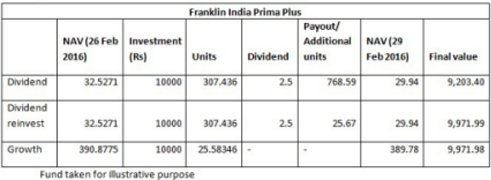

When we look to invest in mutual funds, we come across various options for a single fund such as growth, dividend payout and dividend reinvestment. Many investors want to know if a fund will pay dividend and if you how much it will pay and so on. But from where exactly is the dividend paid and what happens to your NAV on such payment?

Dividend in equity funds Let us first look at the case of dividend in equity funds. First, the dividend paid by companies (stocks) that funds hold should not be confused with the dividend declared by an equity fund. All the dividends a fund receives in the stocks it holds are simply reinvested and show up as growth in your NAV. Whenever a fund chooses to, it may pay dividend from the your NAV, if you have chosen the option. What happens then? A part of your NAV is stripped and paid to you in cash as dividend. There is no dividend distribution tax (DDT) for equity funds. When a dividend is paid out, the NAV falls to the extent of dividend paid. In other words, a part of your profits are given back to you. Suitability: This option can be opted by investors who are more risk averse and also like to have some cash flow from the funds they have invested in. But equity funds seldom declare regular dividends and are also not required to do so. Also, since equity funds are meant for building your wealth, it is not a good idea to be cashing out on it and curtailing your wealth building process. A variant of the dividend option is dividend reinvestment. Under this option, the dividend that is paid out is reinvested back in the scheme as additional units. When a dividend is declared, the NAV of the scheme falls by the quantum of dividend but units are credited at the post-dividend NAV. Technically for an equity scheme the dividend reinvestment and the growth option should yield the same final value on your investment.

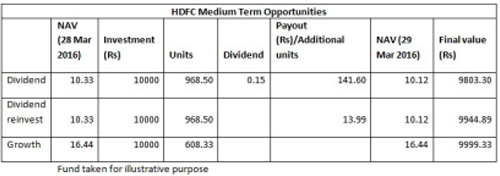

Dividend in debt funds The major difference between dividend declared in an equity and debt fund is that there is dividend distribution tax on the dividends paid by the debt fund. Under the growth option, since there is no dividend that is distributed, the NAV of the fund reflects the appreciation in your holding. In a dividend payout option, your NAV is reduced to the extent of dividend paid as well as for DDT paid. DDT is 28.84% comprising of 25% tax, 12% surcharge and 3% cess. This is not taxed on the dividend you receive. The dividend you receive is considered as being post-DDT and DDT is calculated by working back. Suffice to know that it is done by the fund itself and reduced in your NAV. Hence while it is not taxed in your hands, you are the one who ultimately bears it as it is reduced from your NAV. Under the dividend reinvestment option too, DDT is applicable. Hence the dividend reinvestment option and growth option are not the same. The former will be lower to the extent of DDT reduced in your NAV.

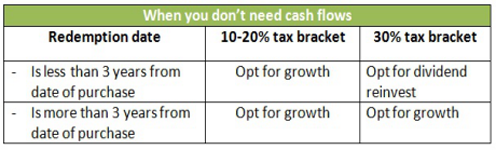

Suitability: If you are in the 10-20% tax bracket you should avoid dividend payout/reinvestment option and simply use a systematic withdrawal plan (SWP) under growth option as your tax outgo will be lower. Also if you do not need any income, it is best to keep the growth option to help compound your money. If you are in the 30% tax bracket and need regular income, it is still better to rely on a SWP than go for dividend payout option. This will ensure you get steady income and get capital gains indexation benefit after 3 years. If you do not need regular income, allow the money to compound with growth as you will get indexation benefits after 3 years.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

Should you choose the dividend option or the growth option?

“Should I go for growth option or take out the dividends in my fund?” - is a question frequently asked by many of you, when venturing into mutual fund investments. We have already discussed how dividends are paid out and how your NAV reacts in our last week’s article - What are dividend and growth options We also summarized what to choose. This week, we elaborate on which option to go for, based on your cash flow need.

Which one to choose?

Two key factors will determine what is appropriate option is for you: 1.Cash requirement and time frame 2.Tax efficiency Most people base their decisions on tax efficiency. While it is a key deciding criteria, let us also look at how other factors too will play a role in choosing between dividend and growth.

Equity funds

Let’s take on the easy one first. Equity funds are meant for the long term. Your reason for choosing an equity fund must be to build wealth towards some goal which is perhaps at least few years away. That simply means you should stay invested in the fund and not take the cash out (unless you will invest the dividends back diligently)to help compounding work for you. Since, long-term capital gains are free of tax, the solution here is simple: As a general principle, go for growth or dividend reinvestment in equity funds.

But there are exceptions: One, in case of theme funds or sector funds that you hold tactically, you may wish to either opt for dividend payouts or book profits as the fortunes of themes can take a turn after one good cycle. Two, in case of ELSS, given that your money is locked in, you may wish to go for a dividend payout if you are in say your 50s and are a bit averse to risk and wash some profits in cash during the lock-in. Young investors should allow their tax saving fund to grow with growth option.

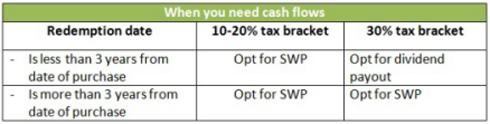

Debt funds: This category gets a bit tricky because the dividend suffers dividend distribution tax (DDT).DDT is nothing but the tax on your dividend. While it is not deducted on your dividend directly in your hands, it is reduced from your NAV. Given this tax component, dividend payout and dividend reinvestment can be tax inefficient. Let us look at whether you need to opt for it.

You need some cash flows from your debt fund : In this case, you can choose the dividend payout or the systematic withdrawal plan (SWP) under growth option. Look at the table below. The SWP is a clear winner for those in the 10% and 20% tax brackets. But please ensure that you do not end up paying exit load. Opt for SWP post the exit load period if you wish to avoid the load.

Those in the 30% tax bracket, can go for dividend payout, if you intend to hold the fund for less than three years. But if you are invested for more than 3 years and redeem post that then growth option makes sense, since you will get capital gains indexation benefit. In such a case go for SWP for regular cash flows. Each such redemption will get capital gain indexation benefit if your investment is over 3 years old. Remember, switching between options will also unnecessarily entail capital gains tax if you have profits. Hence, get your investment time frame right when you start your investment.

You don’t need cash flows from your debt fund : In this case, dividend payout and SWP are not needed since you have no cash flow need. You therefore have 2 options – to go for growth or dividend reinvestment. Look at the table below - growth option scores in most cases, except when you are in the 30% tax bracket and redeem in less than 3 years. This will be true in case of liquid funds or ultra-short-term funds that you may park for a short while. In that case you will suffer DDT of 28.33% (including surcharge and cess) on the dividend reinvested. This will be slightly lower than the income tax slab of 30.9% (including cess). Consider your fresh investments through the above routes. But if you make your switches now, do take into account the exit load and the capital gains, (will vary for each fund) if any, you may suffer on the fund now.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

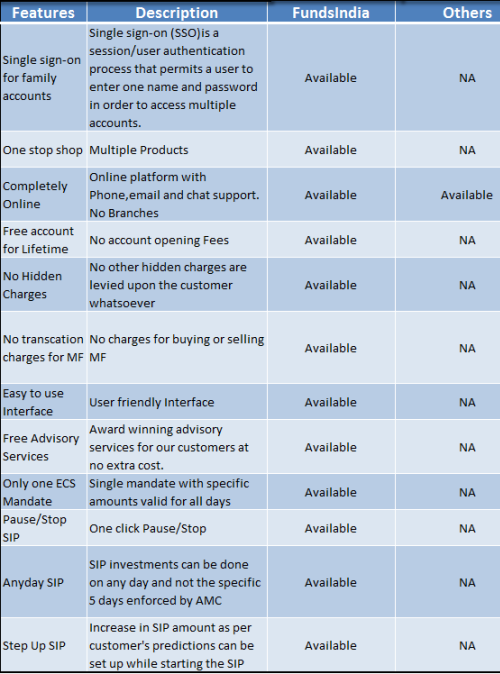

How different is GAURAV FINSERV from others?

Here is a simple comparison between GAURAV FINSERV and other Service providers:

Was this article helpful, Yes or No ?

Have more question than please submit the request.

Explain in detail about the advantages of GAURAV FINSERV.

GAURAV FINSERV is India’s first online-only investment platform that serves customers not just in India, but also abroad. We provide services in mutual funds, equities, deposits, bonds and much more, in a convenient online location without levying any charges on our customers. We thereby provide cost-effective financial products with value-added services that are beneficial to the customer.

SOLID PARTNERSHIP NETWORK : All mutual fund companies available on the GAURAV FINSERV platform for investment.

INTERESTING AND INNOVATIVE SERVICES : GAURAV FINSERV offers functional and innovative services to investors. It provides a platform for investments in mutual funds, equities, deposits and bonds. By combining leading technology and innovative designs, we have provided ways for investors to deploy, manage, and monitor their investments in ways not seen thus far in the Indian financial services industry.

COMMON LOGIN/FOLIO FOR YOUR FAMILY’S INVESTMENTS : With GAURAV FINSERV, you can invest, manage and view the investments of your family members i.e. spouse, kids, and parents, in a consolidated manner using a common login ID. You can invest individually or jointly with them by creating different joint holding mechanisms for their accounts.

BETTER AND EASIER METHODS TO SET UP YOUR SIPS : GAURAV FINSERV offers better and easier methods of setting up your Systematic Investment Plans (SIPs), using which you can ensure that your SIPs suit your specific financial needs and objectives.

SINGLE MANDATE FOR MANY SIPS : In the past, investing in multiple SIPs meant execution of a separate bank mandate for every SIP you wished to invest in. However, with GAURAV FINSERV, you can setup one bank mandate for multiple SIPs across fund houses. This means that you can set up a portfolio of schemes by allotting a percentage of money, and then manage it as a single SIP. For example, you can use a bank mandate of Rs. 25,000 per month, with which you can invest across as many SIPs as you want (say, 5 SIPs of Rs. 5,000 each).

ALERT SIPS : Alert SIPs are useful tools for those who do not wish to execute bank mandates. It helps you control your periodic investments by choosing when and how much to invest every month, thereby alerting you to make investments when required. Every month, we shall send you an email alert, after which you can choose how much to invest, or even skip that month’s investment.

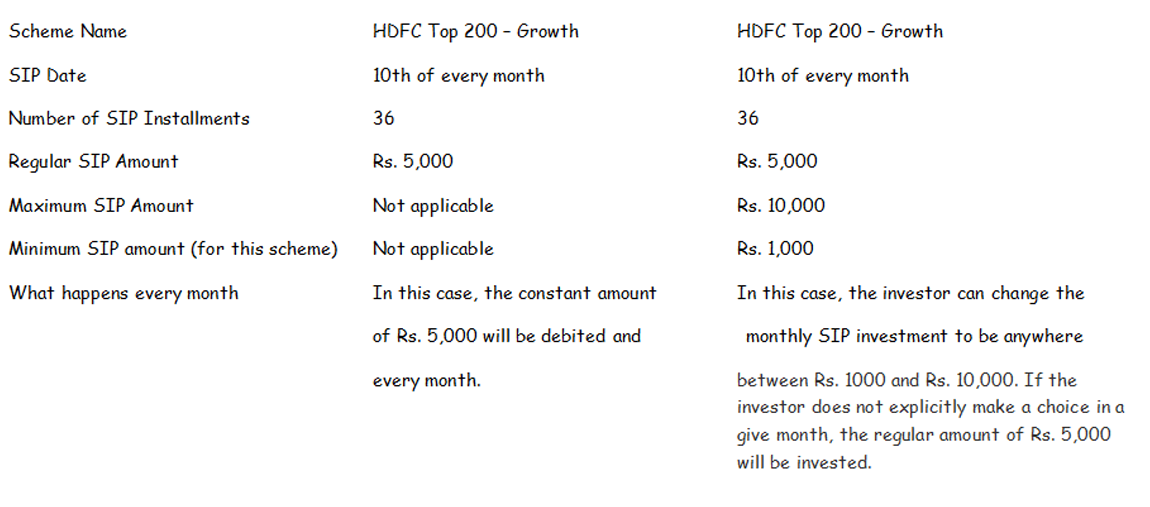

FLEXI SIPS : For investors who are not sure about how much they will be able to save every month, GAURAV FINSERV offers an innovative service called ‘Flexi SIP’. With this service, an investor can choose a mutual fund scheme, a regular investment amount, and a monthly investment date – like for any other SIP. However, the investor will also choose a maximum investment amount, which can be 10 times higher than the regular investment amount. After this, every month, the investor will have the flexibility to set the amount of money he intends to pay for the next installment of his SIP. This value can be any amount between the minimum required SIP amount for that scheme and the maximum amount set by the investor. It is not mandatory for the investor to set this value every month. If he does not do anything about it, then the regular amount will be invested like for any other SIP. Hence, with Flexi SIP, an investor enjoys the dual benefit of hands-off investment towards the SIP, along with flexibility to change the value of investment, if he so desires. The table below further illustrates the concept of Flexi SIPs, as against Regular SIPs.

Regular SIP vs Flexi SIP

INVEST MORE WHEN MARKETS ARE DOWN & LESS WHEN MARKETS ARE UP – VALUE-AVERAGING INVESTMENTS

Was this article helpful, Yes or No ?

Have more question than please submit the request.

How safe and secure is GAURAV FINSERV.com?

GAURAV FINSERV.com is a safe and secure platform with a bank level security. We are registered with entities such as the Association of Mutual Funds in India (AMFI), the National Stock Exchange (NSE)

Was this article helpful, Yes or No ?

Have more question than please submit the request.

Is GAURAV FINSERV authorized by SEBI and NSE?

We are authorised distributor of mutual funds by the Association of Mutual Funds in India (AMFI), and registered with the MSE MFSS

Was this article helpful, Yes or No ?

Have more question than please submit the request.

Who are the promoters of GAURAV FINSERV?

GAURAV FINSERV.com (est. 2009) is an online investment platform, owned and promoted by GAURAV KUMAR (ARN-69452)

Was this article helpful, Yes or No ?

Have more question than please submit the request.

Do you have any branches?

We are an online investment company allowing paperless investing and true to our words and motto we provide support through phone, email and chat and hence we do not have any branches apart from our HQ at MUZAFFARPUR , where we operate from.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

How can we contact you?

Here’s how you can get in touch with someone at GAURAV FINSERV.

To speak to us, you can call us on the below mentioned numbers.

Mobile : (+91) 93348 51876

Call centre timings:

10:00 AM to 7:00 PM (IST) – Monday to Friday

10:00 AM to 4:00 PM (IST) – Saturdays

Sundays : Closed

(Closed all Indian public holidays)

You can also write to us at

You can also write to us at contact@gauravfinserv.com and we’ll get back to you shortly.

GAURAV FINSERV.com is headquartered at Muzaffarpur, Bihar If you are in town, do pay us a visit!

4 STREET

JURAN CHAPRA

MUZAFFARPUR

842 001

BIHAR

Was this article helpful, Yes or No ?

Have more question than please submit the request.

How secure is my data with GAURAV FINSERV?

At GAURAV FINSERV, we go out of our way to make sure that confidential information pertaining to your account and investments are never compromised online. Your GAURAV FINSERV account has been equipped with the best online safety and protection tools that ensure that all your investment transactions always take place in a reliable and secure manner. Network communication with browsers are protected with a 256-bit encryption.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

Can I invest through GAURAV FINSERV by going to a retail outlet?

No, GAURAV FINSERV is an online-only investment platform. You can access all our products and services online by simply logging onto www.gauravfinserv.com

Was this article helpful, Yes or No ?

Have more question than please submit the request.

What is the AUM of your company?

Our company is currently having an AUM of 10+ Crores and growing with 1000+ happy investors investing through us.

Was this article helpful, Yes or No ?

Have more question than please submit the request.

About Sterling MFe

Our Offerings

IRDA licence No. - 9824475 | ARN - 69452